How to Use the Kelly Criterion to Optimize Your Gambling Bankroll

When it comes to gambling, one of the most important aspects to consider is how to manage your bankroll. While the thrill of the game is undeniable, proper bankroll management is the key to long-term success and sustainability. Enter the Kelly Criterion—a mathematical formula that can help you make smarter bets, minimize risk, and maximize the growth of your bankroll.

Whether you’re a seasoned bettor or just starting, understanding and applying the Kelly Criterion can be a game-changer. In this article, we’ll break down how you can use the Kelly Criterion to make better decisions, control your bets, and ultimately optimize your gambling experience.

To dive deeper into the world of betting and to get started, Login to Lotus365 and explore the endless opportunities we offer.

What is the Kelly Criterion?

The Kelly Criterion is a formula that helps you determine the optimal percentage of your bankroll to wager on a bet, taking into account both the odds of the bet and the probability of winning. The goal is to maximize the growth rate of your bankroll while minimizing the risk of losing it all.

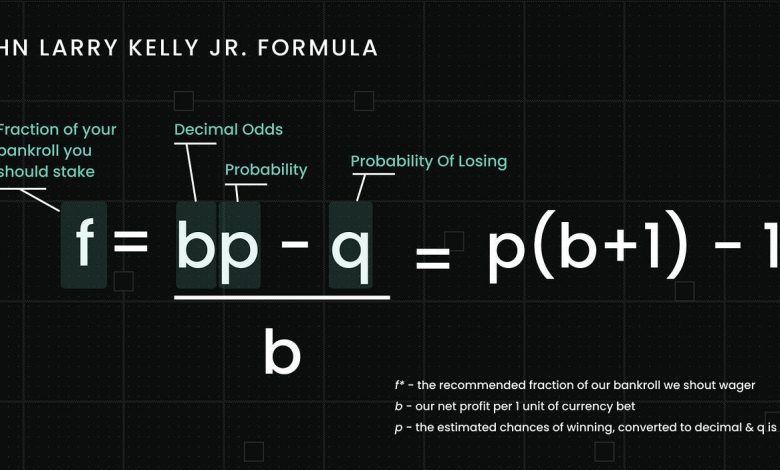

The formula for the Kelly Criterion is:

f∗=bp−qbf^* = \frac{bp – q}{b}f∗=bbp−q

Where:

- f* is the fraction of your bankroll to bet.

- b is the odds you are offered (expressed as a decimal).

- p is the probability of winning the bet.

- q is the probability of losing the bet (1 – p).

In simple terms, this formula calculates how much of your bankroll should be bet on a specific wager to optimize long-term growth.

Why the Kelly Criterion Works

The Kelly Criterion works by striking a balance between risk and reward. If you bet too much of your bankroll on a single wager, you risk losing it all. If you bet too little, you miss out on opportunities to grow your bankroll. By using the Kelly Criterion, you find that sweet spot where your bet size is optimized to grow your bankroll over time.

It’s also important to note that the Kelly Criterion adjusts your bet size based on the odds and your perceived probability of winning. When you find a value bet—where the odds offered are higher than the true probability of an event happening—the formula will suggest a larger bet size.

How to Apply the Kelly Criterion in Gambling

Let’s take an example to demonstrate how the Kelly Criterion works in practice. Suppose you have a bankroll of ₹10,000, and you are considering a bet with the following details:

- Odds: 2.50 (which implies you stand to win 2.5 times your stake)

- Probability of winning: 60% (or 0.60)

- Probability of losing: 40% (or 0.40)

Using the formula, we can calculate the optimal bet size:

f∗=(2.50×0.60)−0.402.50=1.50−0.402.50=1.102.50=0.44f^* = \frac{(2.50 \times 0.60) – 0.40}{2.50} = \frac{1.50 – 0.40}{2.50} = \frac{1.10}{2.50} = 0.44f∗=2.50(2.50×0.60)−0.40=2.501.50−0.40=2.501.10=0.44

This means the optimal bet size is 44% of your bankroll. So, if you have ₹10,000, the Kelly Criterion suggests betting ₹4,400 on this wager.

While this might seem like a high percentage, it reflects the fact that you are confident in your ability to win based on the odds offered. The more confident you are in your bet, the higher the percentage of your bankroll you should wager.

The Risks of Using the Kelly Criterion

While the Kelly Criterion is a powerful tool, it’s important to be aware of some potential pitfalls. For example, the formula assumes that you can accurately assess your probability of winning. If your probability estimate is off, it can lead to over-betting or under-betting.

To mitigate this risk, many bettors choose to use a fractional Kelly approach, where they bet a smaller fraction of the optimal bet size. For example, if the Kelly Criterion suggests betting 44% of your bankroll, you might choose to bet only 25% or 50% of that amount, reducing the risk of a large loss if your probability estimates aren’t perfect.

Benefits of Using the Kelly Criterion

- Maximizes Bankroll Growth: The formula helps you grow your bankroll at the optimal rate without taking excessive risks.

- Risk Control: By adjusting bet sizes based on your edge, it ensures that you don’t risk too much of your bankroll on any one bet.

- Increases Discipline: The formula discourages impulsive betting, ensuring that your decisions are driven by probability and odds rather than emotions.

- Adapts to Changing Odds: As odds change, so does the optimal bet size, which helps you adjust to changing conditions.

Best Practices for Using the Kelly Criterion

- Use Accurate Probabilities: The Kelly Criterion relies on an accurate estimation of probabilities. Be realistic and base your estimates on research and data.

- Apply a Fractional Kelly Approach: To reduce the impact of errors in your probability estimation, consider betting a smaller fraction of the suggested amount (e.g., 0.5 or 0.25 of the optimal bet size).

- Track Your Results: Keep a detailed record of your bets, wins, and losses. This will help you refine your probability estimates and improve your betting strategy over time.

Start Using the Kelly Criterion Today

The Kelly Criterion is a powerful tool for serious gamblers who want to maximize their bankroll while minimizing risk. By incorporating this strategy into your betting decisions, you’ll be able to make more calculated bets and improve your chances of long-term success.

Ready to get started with optimized betting? Login to Lotus365 and take advantage of our competitive odds, secure platform, and world-class betting options.

If you have any questions or need assistance, feel free to Contact Us. We’re here to help you make informed decisions and enhance your betting experience.